2018 Reinsurance Outlook for Captives

December 06, 2017

As we head toward the close of 2017, many captive insurers are in the midst of renewing their reinsurance coverage programs for January 1, 2018. Reinsurance is an integral part of the risk management function for most captive insurers. And, unlike previous years, 2018 may be shaping up as the year when many buyers of reinsurance, including captives, see rate increases for the first time. This article, "2018 Reinsurance Outlook for Captives," pulls together information from several sources, including Swiss Re, Aon Benfield, and Fitch, to provide a summary of expectations for 2018 renewals.

Each year, the Swiss Re Institute publishes a paper on the global insurance and reinsurance markets. The executive summary of this year's report, Global Insurance Review 2017 and Outlook 2018/19, published in November, concludes that property re/insurance pricing could increase significantly.

The multitude of large natural catastrophic (nat cat) events—Harvey, Irma, Maria, earthquakes in Mexico, wildfires in California—in the second half of the year have drained capital out of the re/insurance P&C sector. Price increases in loss-affected segments are already happening and could be substantial. The ultimate volume of losses is not yet known, but it will likely be large enough to cause price rises beyond the affected sectors/regions where profitability has already been under pressure due to low prices (such as in motor and some commercial lines). Given the amount of traditional and alternative capital losses, property reinsurance prices could rise significantly.

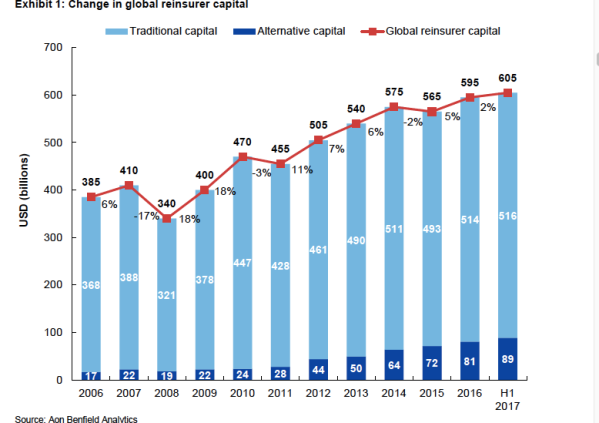

The outlook for the reinsurance sector has changed fairly dramatically since midyear. As reported by Aon Benfield in its September 2017 Reinsurance Market Outlook, global reinsurance sector capital hit a record in the first half of 2017 of $605 billion.

The second half of 2017 produced Hurricanes Harvey, Irma, and Maria; the major earthquakes in Mexico; and the devastating wildfires in California. In a recent article, Fitch Ratings notes the following.

Adding the California wildfires to hurricanes Harvey, Irma and Maria will make 2017 one of the costliest catastrophe loss years in US history, with insured losses reaching $70 billion–$100 billion according to various estimates. In some instances, insurers could ultimately report aggregate 2017 catastrophe losses at levels that strain capital and pressure ratings.

Fitch projects 2017 catastrophe losses for the global insurance and reinsurance sectors could reach $190 billion on a pretax basis. Catastrophe losses for the first time in a number of years are expected to be a capital event rather than just an earnings event for some reinsurance companies. The obvious bright spot in all of this is the high levels of capital the global reinsurers have been able to amass.

Fitch Ratings: 2018 Global Reinsurance Outlook , a September 27, 2017, report, listed pressures on the global reinsurance markets as follows.

- Operating profits are under pressure from rising combined ratios coupled with falling returns on equity.

- Low interest rates continue to challenge reinsurers' investment income.

- Alternative capital capacity continues to grow, offering an alternative to traditional reinsurance.

- The London markets (i.e., Lloyd's) are under pressure from the catastrophe losses of 2017, and this decreases their ability to be a choice for the European and Bermudian markets (see also "Lloyd's Pays $1.7bn So Far for Storms Harvey, Irma and Maria").

As further evidence, pressures on the US reinsurance sector are also revealed in a recent news release from the Reinsurance Association of America (RAA). "RAA Releases Nine-Months 2017 Underwriting Results" reported on the dramatic deterioration in reinsurers' operating results as outlined in its "Quarterly Underwriting and Operating Report."

All of this means that captive insurers should be prepared for rate increases in their 2018 reinsurance renewals. If this prediction comes true, it will also help differentiate those captives that have ridden out the soft market by simply renewing their reinsurance policies and reaping the benefit from falling insurance costs from those that took a more proactive stand.

Captives with a longer-term vision, either driven by their board or through consultation with their reinsurance broker, have used the prior years to invest in mitigating losses and expanding their coverage. These actions include the following.

- Secure increased reinsurance coverage when pricing is extremely competitive. During soft markets, reinsurers are competing for your captive's business; during hard markets, your captive now needs to compete for capacity being offered by the reinsurance markets. Having some excess capacity allows your captive to be better positioned to negotiate in a period of rising rates.

- Restructure your reinsurance program away from a traditional 1-year renewal, or seek better terms and conditions. The time to negotiate these changes is when conditions are soft. Again, by having these already in place, your captive is better positioned when capacity tightens.

- Reinvest your reinsurance savings in additional loss control measures and safety management.

To prepare for 2018, captive insurers should also focus on providing a clear and concise story to their reinsurance underwriters. This means auditing your loss information for accuracy and completeness. Nowhere will this be more important than in property coverages, especially in being able to provide accurate Construction, Occupancy, Protection, Exposure (COPE) data to your underwriter. Second, for large losses, captive owners need to be able to explain the factors that contributed to the loss and what steps have been implemented to prevent future losses of this magnitude.

Whether 2018 turns out to be the beginning of a hard market or not, captive insurers who have been managing their reinsurance needs in the manner outlined above will be in a better position relative to their peers.

December 06, 2017