Captive Basics

Risk Retention Groups: An Important Segment of the Captive Industry

Risk Retention Group (RRG) comprise only 3 percent of the roughly 7,000 captive insurers now operating. This relatively small number of RRGs hides the importance of this segment of the captive industry. Many RRGs are a vital source of coverage for hundreds-even thousands-of their policyholder-owners. Read More

What Is Risk-Based Capital: A Primer for Captives

This primer for captive insurers on the concept of risk-based capital (RBC) describes the four basic components of RBC and how the components fit together to arrive at the ultimate ratio. Read More

Captive Basics: Understanding Liquidity

Captive board members should understand several key concepts. Chief among them is liquidity and how it impacts their captive. This article provides a basic primer on liquidity for both new and seasoned board members. Read More

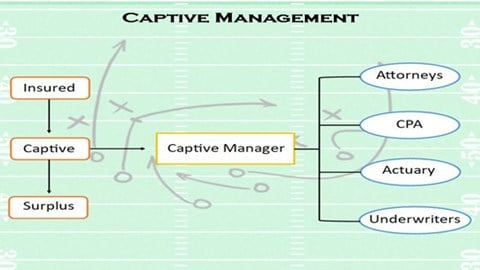

You Own a Captive Insurance Company, Now What?

It is important that new captive owners know what to expect from their captive manager to ensure the captive insurance company is running in a profitable manner and in full compliance with the chosen captive domicile's laws and regulations. Read More

Business Interruption Insurance: A Basic Primer

A captive insurer should have business interruption coverage, as should its members. Editor John Foehl reviews basic questions for consideration when buying or providing coverage for business interruption insurance in this basic primer for captive insurers. Read More