7 Traits of Successful Group Captive Members

Captive Resources | June 20, 2022

Editor's Note: This article was written by Captive Resources, LLC. It examines the group captive option for organizations considering alternative risk transfer solutions in the face of hard commercial market conditions and focuses on some common characteristics of successful group captive members.

Today's prolonged hard insurance market has led to soaring commercial insurance premiums, prompting many companies to explore alternative risk transfer methods. Captive insurance has emerged as a particularly appealing mechanism, but it's not a viable solution for every company. Many organizations lack the necessary scale to warrant forming a single-parent captive (i.e., a captive that's owned and controlled by one organization).

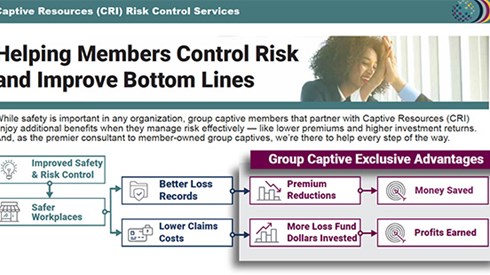

However, that doesn't mean small-to-midsized companies can't leverage captive insurance. The group captive model allows companies to own and operate a captive as a collective. Group captive members enjoy many of the same benefits as their single-parent counterparts—greater control over premium costs, more transparency into claims, profit potential from unused underwriting dollars, etc.—plus the support of their fellow owners.

As with single-parent structures, group captives aren't for every company. There are certain characteristics that successful group captive member companies tend to have that make them uniquely qualified and a good fit for this captive structure. It's not necessarily about a company's industry (members come from an array of industries with a diverse range of risks) or size (although the model does work best for companies with a minimum of $150,000 in combined annual casualty premium); it's more about the company's qualities, how they operate, and what drives them.

To help explain this further, we put together the following list of traits that we've found very common among the group captive members we work with at Captive Resources (which, at last count, is 5,500-plus members across 42 group captives).

No. 1: Entrepreneurial

The transition from an insurance policy buyer to an insurance company owner is best suited for companies with entrepreneurial spirits and the confidence to invest in themselves. Group captive members embrace a risk-reward model where each member invests in itself by retaining more of their company's risk for the reward of potential dividend profits for better-than-expected performance.

No. 2: Proactive

Rather than reacting to incidents by enacting safety policies after the fact, successful group captive members take a proactive approach to risk control by establishing strong programs to address safety issues before they become losses. This proactive approach to risk management is not only a prerequisite of joining a group captive but is amplified once a company transitions from a passive renter of an insurance policy into an active owner of an insurance company. The group captives we work with help the member companies develop this approach by providing ample resources and support (see no. 4 for more information on how members approach risk control).

No. 3: Engaged

Successful members want to take a more active role in their insurance programs, and group captives offer ample opportunities to engage and participate. As equal shareholders in the captive, members have increased transparency into the cost of insurance, claims, and captive operations and are able to take an active role in the company.

The group captive model also rewards members for remaining engaged in activities designed to help control their companies' risk. These activities include attending workshops, undergoing annual risk assessments (and implementing the subsequent recommendations), and sharing best practices with fellow members.

No. 4: Committed to Loss Control and Safety

Group captives attract companies that are already safety-conscious and provide them with the necessary resources and support to take their loss control from good to great. Incoming members are often already high performers regarding safety, claims history, loss ratios, etc. After joining, members tend to perform even better than before, thanks to the group captive support system. This commitment to safety has resulted in group captive members significantly outperforming industry safety benchmarks, according to research by an independent actuary.

No. 5: Collaborative

Group captives can be comprised of tens or hundreds of companies. Sometimes these companies come from similar industries (i.e., homogeneous captives); sometimes they come from disparate industries (i.e., heterogeneous captives). In either case, the most successful group captive members understand the importance of working together by sharing best practices, holding one another accountable, and collaborating on essential decisions necessary to captive operations.

No. 6: Financially Stable

As a co-owner of an insurance company, captive member companies must have the financial strength to cover the collateral obligations of the first few years and the long-term fiscal stability to continuously meet their financial obligations to the captive.

No. 7: Forward Thinking/Forward Looking

While new members often save money when joining, group captives are not a short-term solution to cut costs. Group captives are best suited for companies interested in a long-term method for controlling their insurance destiny, motivated to control costs, and committed to continuous improvement.

Captive Resources | June 20, 2022