China Captives in the Limelight

Luxi "Tanya" Wu | February 15, 2017

EWI Re, Inc.

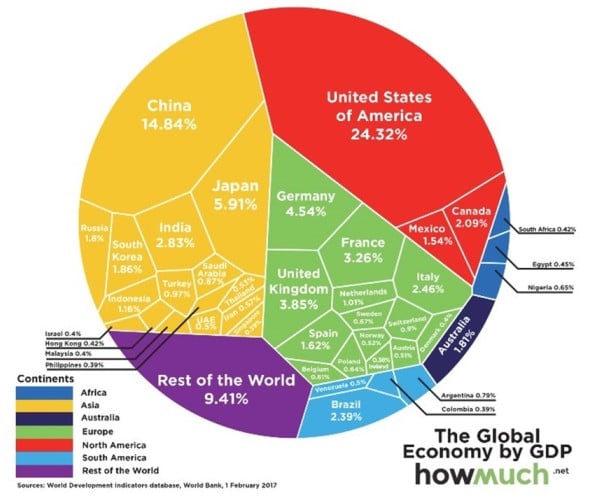

As the number two global economy in the world, China contributed $11 trillion, or 14.8 percent of total global economic output in 2017. In comparison, the United States is the largest economy in the world, contributing $18 trillion, representing one-quarter share (24.3 percent) of the global economy. (See the illustration below.) In contrast, China was responsible for a mere 4.1 percent of the world economy in 1970. PwC's report, The World in 2050, projects that by 2050, China will be the biggest economy in the world.

With robust economic growth and the ensuing insurance penetration expansion, China is proactively raising awareness and interest in alternative risk transfer. The potential for retaining risk layers and the economic accretion it can provide over time are a natural fit for Chinese risk buyers. Moreover, China captives can create opportunities to access global risk markets generally for improved risk syndication.

This article, originally published on Captive.com in early 2017, explores captive insurance developments in China (both mainland China and Hong Kong) and considers opportunities and challenges for future captive development in China.

2017 GLOBAL GROSS DOMESTIC PRODUCT BREAKDOWN

Background

China's insurance industry has sustained robust development momentum in recent years. The China Insurance Regulatory Commission (CIRC) announced that the total premium income for China's insurance industry rose by 18 percent in 2017 to ¥3.66 trillion ($578 billion), possibly exceeding Japan and ranking second in the world only to the United States. China's growth in the world's insurance industry continues, in both life and non-life sectors.

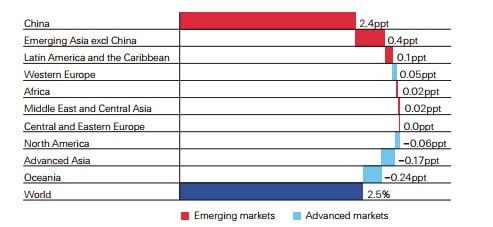

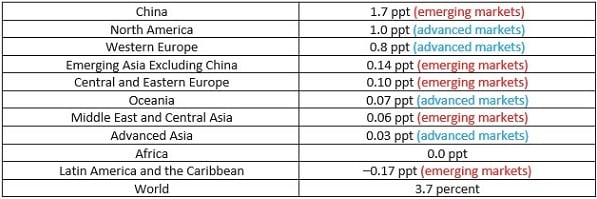

According to a Swiss Re Institute report, sigma 3/2017: World Insurance in 2016: The China Growth Engine Steams Ahead, a breakdown of life and non-life premium growth by region stresses the importance of China as an engine for global insurance growth. The figure below, "Contribution to Real Life Premium Growth by Region, 2016," obtained from a July 2017 news release on the sigma study, reveals that China was responsible for 2.4 percentage points (ppt) of the global life insurance sector's total 2.5 percent premium growth rate in 2016. All other markets combined were responsible for the remaining 0.1 ppt. The next figure below, "2016 Non-Life Premium Growth by Region," also from the sigma study, shows that China accounted for the majority share of growth (1.7 ppt) of the global non-life insurance sector, providing almost as much growth as North America and Western Europe combined.

One major contributing factor is that both large state-owned enterprises and small and medium-sized private enterprises are improving internal operations and developing long-term risk management tools that reflect international best practices that ultimately include captive insurance solutions.

CONTRIBUTION TO REAL LIFE PREMIUM GROWTH BY REGION, 2016

Source: Swiss Re Institute

2016 NON-LIFE PREMIUM GROWTH BY REGION

Source: Swiss Re Institute

Furthermore, in terms of macroeconomic policy, CIRC actively promotes China's insurance penetration. For example, in early 2018, CIRC began a 2-year trial program of viatical settlement to encourage premium increases and strong life insurance premium returns. Alongside this development, to facilitate Insurtech and expedite new product filings, CIRC proactively approved online-only insurance licenses.

Overview of Captive Insurance Development in China

On November 6, 2017, CIRC approved the Chinese state-owned enterprise, Guangdong Yudean Group, to begin its captive insurance business in Guangdong province. The Guangzhou-based power generation company operates internationally and produces coal power, hydropower, gas power, wind power, nuclear power, solar power, etc. The captive, Yudean Captive Insurance, is a single-parent captive wholly owned by the Guangdong Yudean Group with registered capital of ¥300 million ($46 million). The captive is authorized to write property, casualty, credit, guarantee, and short-term medical and accident insurance.

As of this writing, there are six other Chinese captive insurers. Three of these are registered in Hong Kong.

The following Chinese state-owned multinational enterprises insure their parent company risks through a captive insurer: China National Offshore Oil Corporation (CNOOC), China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (Sinopec Group), China General Nuclear Power Group (CGN), China Railway Corporation (CR), and China Ocean Shipping Group Company (COSCO).

Captive Insurance Companies Domiciled in Mainland China

CNPC Captive Insurance Company Limited, China Railway Property Captive Insurance Company Limited (CRCIC), and COSCO Marine Property Captive Insurance Company Limited are three locally incorporated captive insurers domiciled in mainland China.

CNPC Captive Insurance Company Limited

In 2012, China's regulatory body approved the country's largest oil and gas producer and supplier, CNPC, to set up mainland China's first captive insurer. In December 2013, CNPC Captive Insurance Company Limited was incorporated in western China's Karamay City, in the Xinjiang Uyghur Autonomous Region, with registered capital of ¥5 billion ($780 million). The captive insures its own internal group risks, and its top five business lines are property insurance, energy insurance, cargo insurance, marine insurance, and liability insurance.

China Railway Property Captive Insurance Company Limited (CRCIC)

Beijing-domiciled CRCIC is mainland China's second captive insurer. Its operations commenced in July 2015 with registered capital of ¥2 billion ($322 million). The captive insures property, liability, credit, short-term health, and accident insurance for CR and its subsidiaries, along with reinsurance for these lines and other related business approved by CIRC.

COSCO Marine Property Captive Insurance Company Limited

The CIRC approved Shanghai-based captive insurer, COSCO Marine Property Captive Insurance Company Limited on December 5, 2016. With registered capital of ¥2 billion ($291 million), the captive is a wholly owned subsidiary of COSCO, one of the largest shipping companies in the world. The captive insurer provides fleet and cargo, civil liability, and property cover. The captive was unveiled in Shanghai on February 17, 2017.

The China Insurance Regulatory Commission

CIRC officially introduced the captive insurance concept in China for the first time when it adopted the Circular of the Supervision of Captive Insurance Companies, effective on December 2, 2013. The circular established China's supervisory approach to captive insurers.

In addition to general insurance regulations, the following three conditions must be met in order to form a China-based captive insurance company.

- The registered capital shall match the risks borne by the company.

- Investors shall be large-scale business enterprises with an outstanding main business, profitable performance, and total assets of no less than ¥100 billion ($14.5 billion).

- The parent company must face a high concentration of risk, have geographically diversified distribution, face difficult risk transfer challenges, and have stable insurance needs and strong risk management capabilities.

On February 15, 2015, CIRC issued another circular supervisory for captive insurance companies. The major additional regulation set forth by this circular is as follows.

- A captive insurance company may set up wholly owned insurance subsidiaries and insurance asset management companies onshore and offshore. Prerequisites for applying to the insurance asset management company are that the company must have been operating for 3 years and the number of total assets of the asset management company in the prior year exceeds ¥5 billion ($730 million).

Captive Insurance Companies Domiciled in Hong Kong

CNOOC Insurance Limited (authorized in 2000), Sinopec Insurance Limited (SIL) (authorized in 2013), and CGN Captive Insurance Limited (authorized in 2014) are captive insurance companies domiciled in Hong Kong with parent companies in mainland China.CNOOC Insurance Limited. Headquartered in Beijing, CNOOC is an international energy company with business segments that include oil and gas exploration and development, engineering and technical services, refining and marketing, natural gas and power generation, and financial services. At the end of 2017, CNOOC's captive insurer, CNOOC Insurance Limited, had total assets reaching ¥4.723 billion with increased underwriting capacity surrounding major disasters.

Sinopec Insurance Limited (SIL)

Hong Kong-based captive insurer SIL insures overseas operations for oil refining, gas, and petrochemical company Sinopec Group. SIL is a wholly owned subsidiary of Beijing-based Sinopec Group. At the end of 2017, 89 percent of Sinopec Group's insurance premiums flowed through SIL.

CGN Captive Insurance Limited

Shenzhen-based China General Nuclear Power Group (CGN) is a multinational manager/operator of nuclear power stations. In addition to offering power generation, power station construction, and electricity transmission, the parent company is also engaged in wind power, hydropower, and solar energy.

Hong Kong has a simple tax regime with a corporate profit tax rate as low as 16.5 percent and a maximum personal income tax rate of 15 percent. To further promote captives in Hong Kong, the Legislative Council of Hong Kong passed the Inland Revenue (Amendment) (No. 3) Bill 2013 on March 19, 2014, to provide a tax concession for captive insurers. As a result, captives enjoy a 50 percent profits tax reduction on their offshore insurance risk. The concession took effect from the assessment year 2013–2014 and onward.

Hong Kong's salient regulatory concessions to captive insurers are highlighted in the following chart.

| HONG KONG CAPTIVE INSURER REQUIREMENTS | ||

| Item | General Business Insurer | Captive Insurer |

| Minimum Capital Requirement | HK$10 million (US$1.3 million) | HK$2 million (US$258,000) |

| Solvency Margin |

The greatest of 1. Generally 20 percent of the relevant premium income; or 2. Generally 20 percent of the relevant claims outstanding; or 3. HK$10 million (US$1.3 million) |

The greatest of 1. 5 percent of the net premium income; or 2. 5 percent of the net claims outstanding; or 3. HK$2 million (US$258,000) |

| Requirement for Assets in Hong Kong | To maintain assets in Hong Kong of an amount not less than 80 percent of its Hong Kong liabilities plus solvency margin | Exempted |

| Valuation Regulation | Assets and liabilities to be valued on statutory basis as prescribed by Valuation Regulation | Assets and liabilities to be valued on the basis of generally accepted accounting principles |

| Source: Office of the Commissioner of Insurance, the Government of the Hong Kong Special Administrative Region | ||

Opportunities for Future Development in the China Market

As an emerging player on the captive insurance scene, the Chinese market presents a number of opportunities, some of which are highlighted below.

More Offshore Captive Insurers with Parent Companies in China

In 2016, China National Petroleum Insurance, a captive unit of CNPC, prepared to establish an offshore captive unit in Singapore in addition to its existing captive in China. This was a milestone for captive insurance companies in China toward global expansion. Singapore offers a 10-year tax-free income benefit for offshore business, along with a favorable regulatory environment. As of December 2017, Singapore had 69 captive insurance companies.

In 2016, the Guernsey International Insurance Association committed to China's captive insurance market development when it signed an agreement with both the China Captive Alliance and the Kashgar government. During 2017, Guernsey made significant progress in nurturing captive opportunities with China-based businesses, welcoming at least three Chinese delegation visits to the island. By late 2017, Guernsey reported that it had signed four insurance-related memoranda of understanding with its China counterparts encompassing all of China's financial services regulators.

As China's state-owned enterprises expand overseas, they exhibit interest in achieving standards seen internationally, including risk management and consolidated insurance buying through captive insurance programs.

Macro Policies Promoting China's Overseas Infrastructure Construction Will Encourage Chinese Companies To Create Captives

In 2015, China launched the $40 billion Silk Road Fund for Belt and Road initiative projects. Current projects are funded by the Chinese Development Bank, the Agriculture Development Bank, and the Export-Import Bank of China. In addition to China, 64 countries in Asia, Africa, and Europe have participated in the initiative. Jointly, these 65 countries account for 62.3 percent of the world's population, 30 percent of its gross domestic product (GDP), and 24 percent of its household consumption.

Its development in new rail, roads, and ports in these 64 countries is a boon to China. Since the initiative began in 2015, Belt and Road initiative projects have accounted for more than 40 percent of China's overseas construction projects. China's GDP growth fell below 7 percent in 2016 for the second consecutive year, making Silk Road connections more critical for private-sector growth outside of China—especially in further enlarging infrastructure manufacturing capacity, which in turn presents more opportunities to create captive insurance companies for industrial Chinese parent companies and joint ventures.

Captives could be created both individually for larger entities and on a group basis for smaller companies with a common nexus (e.g., transportation companies) creating a mechanism to provide customized manuscripted insurance policies for organizations, supported by global reinsurance capital.

Challenges for Future Development in the China Market

The interest in setting up captive insurance companies in China has become intense, especially with the internationalization of Chinese enterprises and overseas expansion. However, there are major headwinds for captive formation in China, as follows.

High Cost

According to CIRC, investors shall be large-scale business enterprises with an outstanding main business, profitable performance, and total assets of no less than ¥100 billion ($14.5 billion). Although the registered capital of the captive insurance company is not clearly defined, according to China's existing insurance regulation, registered capital must be no less than ¥200 million ($29 million). Currently, the four mainland China-domiciled captives have registered capital of $46 million, $780 million, $322 million, and $291 million, respectively. The required capital for captive insurers registered in Bermuda is $120,000 and $100,000 in the Cayman Islands. By comparison, there is clearly a vast cost gap between China and alternative domiciles such as these.

Captive Insurance versus General Insurance

To protect traditional property and casualty (P&C) insurers, Chinese regulators treat captive insurers similarly to general P&C companies. Therefore, captives domiciled in the mainland do not enjoy significant tax benefits and must post a high initial amount of registered capital.

Profit Center versus Risk Management Evolution

In China, the captive insurance movement is still in the preliminary development stages but is poised to take off. Generally, captives are considered solely as vehicles for retaining independent profit, preserving capital, and receiving tax benefits. Thus, the beauty of the risk management concept has not been favorably received when parent companies apply to CIRC for approval to establish captive insurance companies.

Lack of Captive Insurance Talent

China is in great need of people with knowledge and experience in captive insurance operations and management as well as expertise in domestic and international reinsurance markets.

Conclusion

Asia Pacific is gradually taking center stage in the insurance industry, and it is China that is grabbing the headlines. With the mind-set of developing long-term risk management strategies that reflect international best practices, China's insurance regulators, captive insurance companies, industrial companies, and various stakeholders are following the United States and other advanced markets' routes in developing captive insurers in the region. However, it is important to remember that only through "Thinking globally and acting locally" can China's fledgling captive insurance movement set another milestone in the global insurance industry.

Luxi "Tanya" Wu | February 15, 2017