Captive Compliance 101: A Checklist for Maintaining a Healthy Captive

Jeremy Colombik , Rosa Garcia | March 20, 2019

Keeping your captive compliant is key in the event of an audit or Internal Revenue Service (IRS) challenge. Making sure that your captive insurance company is bulletproof begins with verifying it is set up for the right reasons. Once set up, your captive should remain compliant with all applicable regulations and laws. This article discusses areas that an active captive insurance company should review frequently to remain compliant and in good shape.

Some of the important items to include in your compliance checklist are as follows.

- Was a feasibility study done for your captive to determine its viability during the formation stage?

- Once your captive insurance company is formed and open for business, does it keep up with regulatory compliance within the captive domicile where it is operating?

- Is your captive taxed as a US company? If so, did the captive file a US tax return?

- Were the necessary audits completed (depending on the jurisdiction)?

- Did you file Form 8886 (if applicable)?

- Were premium indication letters sent for your captive's insurance policy renewals?

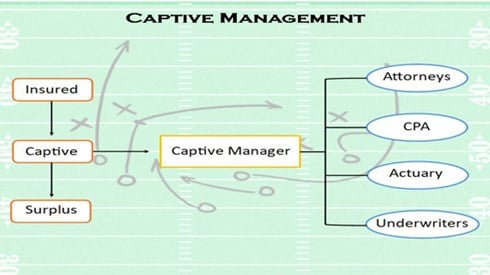

Although compliance specifics may vary from domicile to domicile, depending on the jurisdiction, captive owners should be confident that they are working with an expert captive manager that can keep their captive in good standing by following all applicable regulations and laws.

Feasibility Study

All compliant captive insurance companies must commence with a feasibility report before captive formation can begin. This is an important first step in getting your captive approved, and generally captive domiciles require that this report is completed by an actuary. A feasibility report is vital as it provides a comprehensive risk analysis of coverages being offered by the captive as well as financial projections reflecting both adverse and conservative scenarios. An actuary will require that a risk assessment questionnaire is completed by the prospective captive owner(s) and will also request other financial information, such as tax returns, from the business(es) that the captive will be insuring.

Regulatory Compliance

Once your captive has been approved and is formed, it must continue to maintain regulatory compliance within the captive domicile where it operates. Domiciles typically have a specific list of requirements for a licensed captive to be in good standing. Some of these requirements include a business plan, an investment policy statement, reinsurance agreements, ownership structure, and annual filings/annual reports.Annual reports, if not waived, provide the regulatory body with a clear picture of the captive's solvency and financial situation. As one might imagine, these reports can be quite tedious and time consuming. Thus, it is important to plan accordingly and file with enough time to assure they are done correctly. Additionally, from time to time, a domicile may incorporate procedural revisions surrounding when filings must be reported, and it is important to stay on top of your captive domicile's current processes.

Your annual report should also note whether your captive is reporting in generally accepted accounting principles (GAAP), modified GAAP, or statutory accounting principles, which can potentially affect how the report is presented. If you plan on making a change in the accounting method utilized by your captive insurance company, you will first need approval from the department of insurance (or other regulatory body) for your captive's domicile.

You may also be required to prepare the National Association of Insurance Commissioners annual report along with the state annual report if your domicile is in the United States. Some domiciles offer a waiver for the annual report, in which case you will only need to provide an audit at your captive's respective due date. Other domiciles could require premium tax returns, if applicable; captive fees, as established in the regulatory body; or license approval. Most of the above-mentioned domiciliary requirements need to be filed within the first quarter of the year, so be sure to check the deadlines for your specific domicile.

Onshore or Offshore

Another area that needs attention is whether or not your captive will be taxed

as a US company. If it will be taxed as a US company, a US tax return is required to be filed in

addition to an annual audit (depending on the domicile in which your captive operates). If your

captive is formed onshore or your offshore captive is to be taxed as a US company, the 1120-PC

tax return is required to be filed. Furthermore, an offshore captive will require a 953(d) tax

election to be taxed as a US company.

An onshore captive, or US-based captive, is

required to file an 1120-PC tax return. The filing due date for an 1120-PC is April 15. A

6-month extension may be requested by submitting IRS Form 7004, also due by April 15. Regarding

captive audits, US domiciles generally mandate yearly audits; however, some states as well as

other non-US domiciles do not require them. While you could apply to have your captive audit

waived, we are of the opinion that it is good to have a third party conduct an annual audit for

the benefit of the shareholder(s).

Notice 2016-66

There has been much (mostly negative) press regarding Notice 2016–66 (the Notice), which deals with IRS Form 8886. Completing this form is a requirement and therefore key to keeping your captive in compliance. Form 8886 has to do with captives taxed as US companies and may apply to your captive if you qualify according to the Notice.

The Notice has certain parameters for qualification that center around captives electing 831(b) tax status. If your captive is not electing 831(b) status, then Form 8886 will not apply. Almost all captives electing 831(b) status will qualify and will require this form to be filed.

According to the IRS instructions on Form 8886, you must "[a]ttach Form 8886 to your income tax return or information return (including a partnership, S corporation, or trust return), including amended returns, for each tax year in which you participated in a reportable transaction." If you qualify and do not file this form, there are severe consequences, including costly financial fines. Therefore, it is important that you are 100 percent certain your captive does not qualify under the Notice if you are not completing this form.

Premium Indication Letters

Premium indication letters are an important function of running a captive. Since a captive is an insurance company and needs to run as an insurance company, insurance companies big and small are required to send out premium indication letters, also frequently referred to as "renewal letters." A premium indication letter will generally be sent out 3 months before the renewal date of your insurance policy(s) and may request information such as the following.

- Has your company had any expenses for losses that were not covered under your current policy?

- Have your company's gross revenues decreased significantly?

- Are there any other risks, gaps in coverage, or policy exclusions that could harm your business?

The premium indication letter will also indicate the current coverage(s) provided by your captive, the coverage limits, and the premium amount required for each coverage.

Conclusion

As discussed above, maintaining captive compliance is crucial and should be monitored against a captive compliance checklist. To keep a captive insurance company in good standing, it is important to check with your own captive domicile(s) surrounding specific requirements, regulations, and due dates that may vary across domiciles. An experienced captive manager should provide you with a calendar of all due dates, maintain complete transparency in all record keeping, and provide you with assurance that your captive is following domicile regulations and laws.

Jeremy Colombik , Rosa Garcia | March 20, 2019