5 Ways Group Captives Help Members Foster a Culture of Safety

March 15, 2023

Editor's Note: This article is contributed by Captive Resources, LLC. It examines the role the group captive option can play in helping organizations develop a culture of safety and safer workplaces.

In group captive insurance, members' ability to create a safe workplace is pivotal in lowering their total cost of risk. The foundation of a safe workplace is a culture of safety that ultimately drives superior loss performance. Creating a culture where employees understand the importance of safety and maintain it as a top priority is a hallmark of companies that find the most success in a group captive.

Workshops, educational webinars, and periodic in-depth assessments are among the many risk control resources that captive members can access. However, creating a safety-oriented culture requires more strategic commitment. The foundation of Captive Resources' group captive model is risk control and safety. As such, there are multiple aspects that support and enable members' efforts to holistically instill safety into their day-to-day cultures.

1. Recruiting Safety-Conscious Companies

Finding and recruiting the right types of companies to become members is essential for group captives. This begins with identifying companies that have a particular mindset. They understand the importance of a safety culture, are already committed to controlling risk, and have a semblance of a safety program in place. Joining a group captive gives these members the necessary resources to take their safety programs to the next level.

A thorough vetting process includes evaluating prospective members' safety programs. The process might entail a complete in-depth risk control assessment.

2. Incentivizing Safety Performance

Group captives reward members for their commitment to safety. Unlike many traditional insurance plans, the group captive model directly rewards members for superior loss performance. Members are incentivized to build and continually nurture a culture of safety. Incentives take two main forms.

- Lower premiums. The model empowers members to reduce their premiums. If members make their workplaces safer as reflected by their most recent 5-year loss histories, the resulting loss frequency and severity improvements generally lead to lower premiums.

- Dividend potential. Unused loss funds and investment income are returned to the members as dividends.

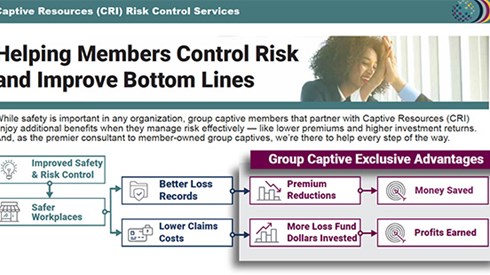

Our "Helping Members Control Risk and Improve Bottom Lines" infographic has more information about the financial savings group captive insurance offers.

3. Saving Lives and Limbs

Our group captive model has effectively reduced workplace incidents, injuries, and deaths. Compared with the average company, members of group captives we support have significantly better safety records. The underlying independent study found that, compared with industry benchmarks, member companies had the following.

- 48 percent fewer fatalities

- 39 percent fewer lost time claims

- 22 percent fewer total workers compensation claims

But the advantages go beyond claim counts and loss costs. A culture of safety also produces potentially less tangible, yet equally valuable, benefits such as employees' increased productivity, safe feelings in the workplace, and improved morale that comes with making it home alive and healthy every night.

4. Obtaining Buy-in at All Levels

Developing a culture of safety requires buy-in from an entire organization. It often starts at the top among owners and organizational leaders who are already safety-conscious. Having bought in, they use various methods to encourage adoption at all organizational levels. Here are a few examples of the methods.

- Safety mandates. Leadership gives safety mandates to middle management, which then implements specific policies.

- Financial rewards. Often, member companies offer monetary incentives for improved safety performance. For example, trucking companies might pay drivers bonuses for accident-free periods.

- Increased communication. Leadership strives to keep safety top-of-mind throughout the organization through increased communication. It might include explaining how safety benefits everyone—the company saves money, employees earn financial incentives, and everyone is healthier and happier.

5. Empowering Members via Ownership, Transparency, and Collaboration

The member-owned group captive model gives members an equal stake in insurance program ownership. A natural impetus to partner with fellow member co-owners springs from a sense of ownership.

As owners of their insurance companies, members enjoy several benefits that promote a safety culture. Beyond financial benefits like dividends, members also have transparent access to claims and other data that enable them to see how improved performance directly impacts their bottom line. Also, the data often reveal areas with opportunities to improve.

Because they share risk, members are incentivized to encourage and challenge each other to make their workplaces safer and control losses. As equal stakeholders, members understand the importance of collaborating to help each other strengthen their safety cultures. Group captive members attend regular risk control workshops and board meetings where they learn from risk control professionals and share best practices.

All these benefits combine to help group captive member companies facilitate a culture of safety. If your company is already safety-conscious and wants to take safety to the next level and be rewarded financially, group captive insurance may be a good fit.

March 15, 2023