Severe Thunderstorms Drive First Half of 2024 Insured Losses to $60 Billion

August 16, 2024

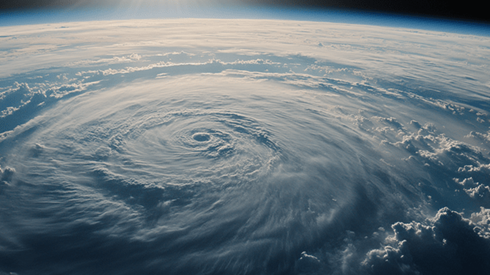

Global insured losses from natural catastrophes in the first half of 2024 reached $60 billion, according to preliminary estimates by Swiss Re Institute. This figure is 62 percent above the 10-year average, making the first half of 2024 the second costliest on record for insured losses from severe thunderstorms. These storms, particularly prevalent in the United States, accounted for 70 percent of the total global insured losses.

Total economic losses for the first half of 2024 were $127 billion, with natural catastrophes accounting for $120 billion of this total.

Balz Grollimund, head of catastrophe perils at Swiss Re, emphasized that severe thunderstorms have become a significant driver of increasing insured losses. "Multi-billion-dollar loss events from this peril are likely to become more common," he said, attributing this trend to growing populations, higher property values in urban areas, and the vulnerability of insured properties to hail damage.

Severe thunderstorms, which include phenomena such as strong winds, tornadoes, hail, and heavy rain, resulted in $42 billion in insured losses globally in the first half of 2024. In the United States alone, 12 separate storms each caused losses exceeding $1 billion. Swiss Re Institute's Sigma report highlighted that insured losses from severe convective storms in the United States have risen by around 8 percent annually in nominal terms since 2008.

Flooding also contributed significantly to the above-average losses in the first half of 2024. Events in the United Arab Emirates (UAE), Germany, and Brazil were particularly impactful, with floods accounting for 14 percent of global insured losses. The UAE experienced its costliest natural disaster on record when severe thunderstorms led to flash floods in April, causing insured losses estimated at $2 billion.

August 16, 2024