How To Set Up a Captive Insurance Company: A 5-Step Primer

April 10, 2019

Captives are used by the vast majority of Fortune 500 companies to finance their own risk. In fact, there are approximately 7,000 captive insurance companies domiciled in more than 70 regulatory jurisdictions worldwide.

A captive insurance company is set up to insure the risks of its owners and is an integral part of a good risk management program. Specifically, a captive insurance company is "an insurance company that is wholly owned and controlled by its insureds; its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer's underwriting profits." This includes pure captives, association captives, and industrial insured captives.

How do you set up a captive insurance company?

Find out about the key steps necessary to successfully establish a captive insurance company in the following five-step primer on setting up a captive.

Step 1—Determine the Likely Captive Structure

There are many different types of captive insurers. So, the first step in setting one up is to determine which type of captive might be most suitable for your risk management needs. A number of different captive insurance company options are described below.

Single-parent captive—A single-parent captive or "pure" captive is a separate legal entity formed as a subsidiary to a parent organization. The parent owns and controls the captive to insure the risks of the parent company and its affiliates.

Association captive—An association captive, also known as a "group" captive, is formed by a group of individuals or entities sharing homogeneous or heterogeneous risks that agree to jointly own the captive to insure the risks of the member-owners. In some instances, an association may act as the sponsor of the captive to facilitate its formation.

Risk retention group (RRG)—A risk retention group is an insurance company formed and operated pursuant to the federal Risk Retention Act of 1981, as amended in 1986, that allows the policyholder-owned insurer to underwrite most types of liability risks under the primary regulatory authority of its state of domicile without being encumbered by nondomiciliary state licensing laws and regulatory oversight.

Agency captive—An agency captive is a captive insurance company established by an insurance agent or broker created to underwrite and insure (or reinsure) a portion of the book of business that the agent or broker writes typically because the agent believes the book of business will produce an underwriting profit and the agency is looking to expand its sources of revenue.

831(b) captive—The Tax Reform Act of 1986 created the 831(b) section of the Internal Revenue Code, making it advantageous for small- and mid-market companies to own their own insurance company. An 831(b) captive is a captive that may be taxed under Internal Revenue Code § 831(b), which provides that a captive qualifying to be taxed as a US insurance company may pay tax on investment income only in any year that its written premium is at or below the threshold for the applicable tax year, which in 2017 was set at $2.2 million or less with the premium cap subject to inflation adjustments. Such captives are also known as "micro-captives."

Rent-a-captive—Certain captive insurers, typically established by an insurance broker or captive management company, can provide all of the services normally associated with a captive to other entities for a fee. Rent-a-captives are an interim step for organizations interested in forming a captive but not looking to incur all of the frictional costs to initially set up their own captive insurers.

Protected (segregated) cell captive—This option involves a captive setting up a separate account or "cell" for each insured entity. These captives are similar in nature to rent-a-captives; however, in this arrangement, the cells isolate losses incurred by the insured party from all other entities involved in the captive.

Captive tax issues—Regardless of the format you choose, there are three fundamental elements that must be present for the captive to constitute insurance for federal income tax purposes. These three elements are as follows.

- The arrangement must involve the existence of "insurance risk."

- There needs to be both risk shifting and risk distribution.

- The captive exists to provide "insurance" in its commonly accepted sense.

For a greater understanding of these elements and to make sure they are present in the captive you are seeking to create, read " When Are Premiums Paid to a Captive Insurance Company Deductible for Federal Income Tax Purposes?"

Step 2— Conduct a Captive Feasibility Study

Once you determine which of the basic captive structures might best suit your risk management needs, the next step in the process is to conduct a captive feasibility study. A captive feasibility study is a study undertaken to determine whether a contemplated risk financing program is feasible for a particular organization or group of organizations.

A study, or a proposal for a captive feasibility study, should always begin by stating its scope and purpose. If the purpose is simply to fulfill a requirement that a captive submit a feasibility study as part of the application filing, the study will simply focus on what a regulator will need to review: the assumptions used in producing the captive's financial projection. The study becomes, in essence, a business plan, with actuarial support for the loss assumptions, a description of any reinsurance protection behind the captive, and an explanation of how the capital requirements of the selected domicile will be met. Read more in "What Are the Key Elements of a Captive Feasibility Study?"

While not all domiciles require a captive feasibility study, any organization that is serious about its risk control program and is considering a captive should conduct one. The study provides detailed information allowing the organization to make an informed decision as to whether a captive program will be beneficial.

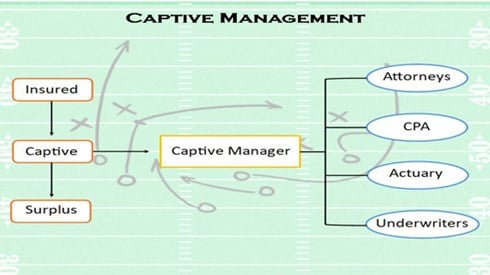

Step 3— Interview and Retain a Captive Manager

While not all captives will operate using a captive manager, the vast majority do. A captive manager plays a key role in the formation, development, and overall success of the captive. A captive manager brings the following areas of expertise to the table: accounting, actuarial, claims management, domiciliary and regulatory, investment management, pricing and underwriting, and potentially tax. While the captive manager may not be an expert in all of these issues, it has established vendor networks in all of these areas that can assist your organization in securing the right professional partnerships.

Questions for consideration in hiring a captive manager include the following.

- Scale versus local knowledge—if the captive will operate only in a single state, then local knowledge may be more important. For captives operating on a national or international basis, a larger-scale firm may be the right choice.

- Capacity—does the firm have enough talent to ensure the workload from adding your captive to the mix gets done accurately and on time?

- Reputation—what is the firm's reputation? Can you speak with both existing clients and former clients when doing a reference check?

- Domiciliary expertise—understanding local regulations and tax issues is key to the functioning of the captive.

- Costs—what are the fees associated with running your captive, and what is included within the fee structure? How will work outside of the fee structure be billed?

Many captive managers have the expertise to perform captive feasibility studies. So, one way to get to know a captive manager is to hire it on a stand-alone basis to conduct the captive feasibility study. If you choose to go this route, make sure you retain the rights to the captive feasibility study so that you can potentially change captive managers if you need or want to do so.

Step 4— Select a Domicile

Equally important to the success of a captive insurance company is selecting the best domicile for the captive. There are now more than 70 captive domiciles worldwide, and, while all may not be an option for your captive, a good partnership with your regulators is extremely beneficial. Your captive manager should assist you with considering prospective captive domiciles. Key elements to look for include the following.

- Political stability

- Enlightened regulation

- Access

- Support services

- Cost

Step 5—Preparation and Submission of a Captive Application

Once you have determined where you want to domicile your captive, the final step in the process requires you to complete and submit an application and all additional materials to your chosen domicile. Your captive manager will assist you in the completion of the necessary materials. You will also need to provide the domicile with evidence that you have the necessary capital required for the captive in a form suitable to the regulator. Approvals typically can take 90 days or more, although domiciles are becoming better at streamlining this process.

Conclusion

It is relatively easy to set up a captive insurance company by following these five steps. Of course, the process is likely to go much smoother and with fewer mistakes if a competent captive professional, such as one of our Captive.com sponsors, is available to help you navigate the process.

April 10, 2019